Why Learning How to Save ₹1000 Every Month Matters

“Bro, how do I even start saving ₹1000 when I’m barely surviving the month?”

Sound familiar?

You’re not alone. Many of us are caught in the cycle of spending everything we earn. But even a small buffer can make a big difference. Learning how to save ₹1000 every month = ₹12,000/year. That could be:

- Your emergency fund

- Seed money for investing

- A ticket out of financial stress

Saving money = buying freedom.

Can You Save While Living Paycheck to Paycheck?

Yes, you can. But you need:

- Clear awareness of where your money goes

- Small consistent actions

- A mindset shift from “I can’t” to “How can I?”

And you need a plan. This guide on how to save ₹1000 every month is that plan.

How to Save ₹1000 Every Month – 10 Proven Strategies

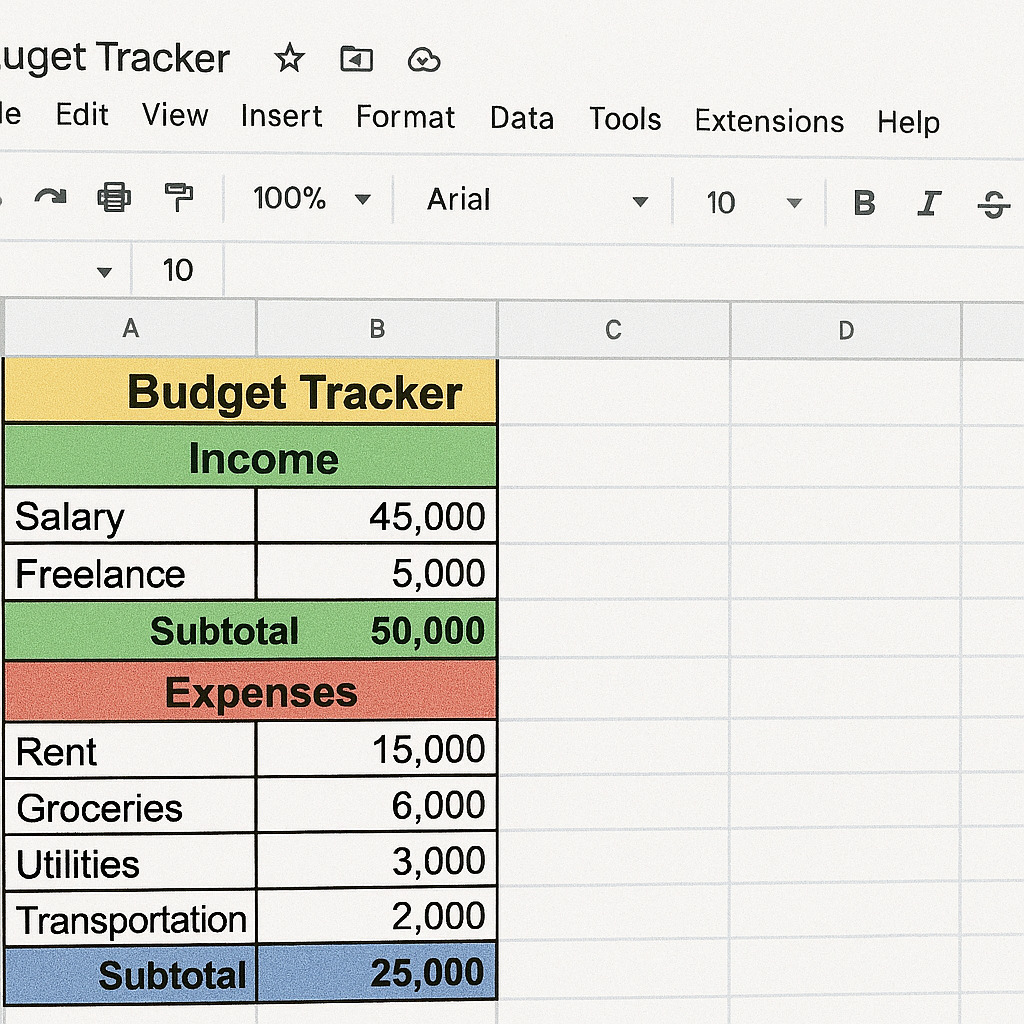

1. Track Every Rupee

Use a simple spreadsheet or app like Walnut(axio) or Money Manager.

You can’t change what you don’t track. And if you’re serious about how to save ₹1000 every month, this is where it begins.

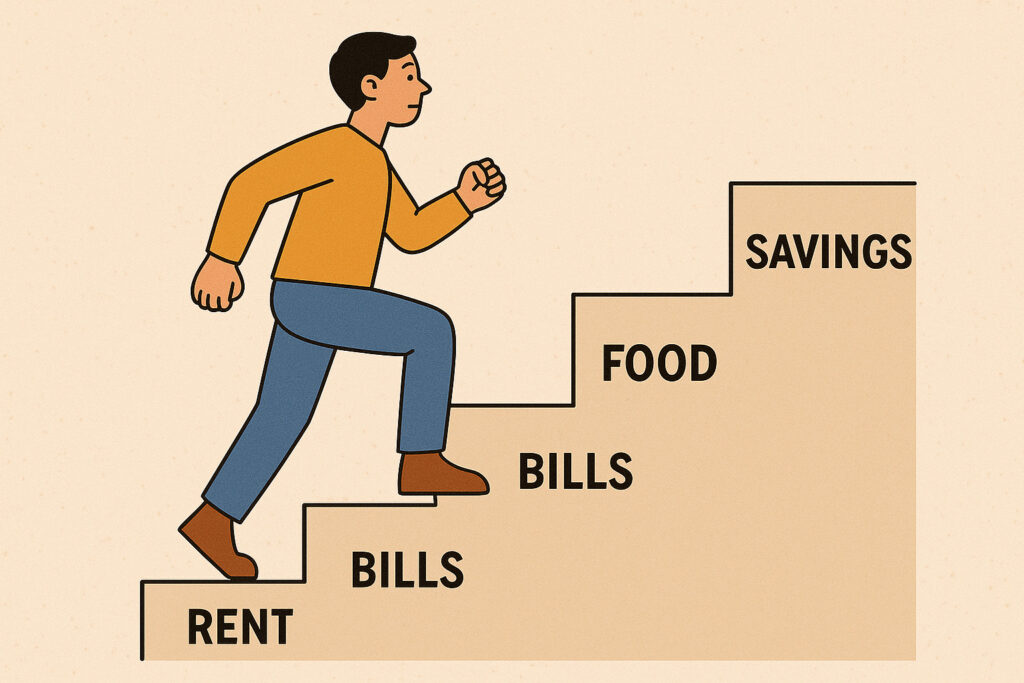

2. Create a Zero-Based Budget

Assign every rupee a purpose. Income – Expenses = Zero.

Use categories like rent, groceries, transport, and yes, savings!

This helps you consciously plan how to save ₹1000 every month instead of wondering where your money went.

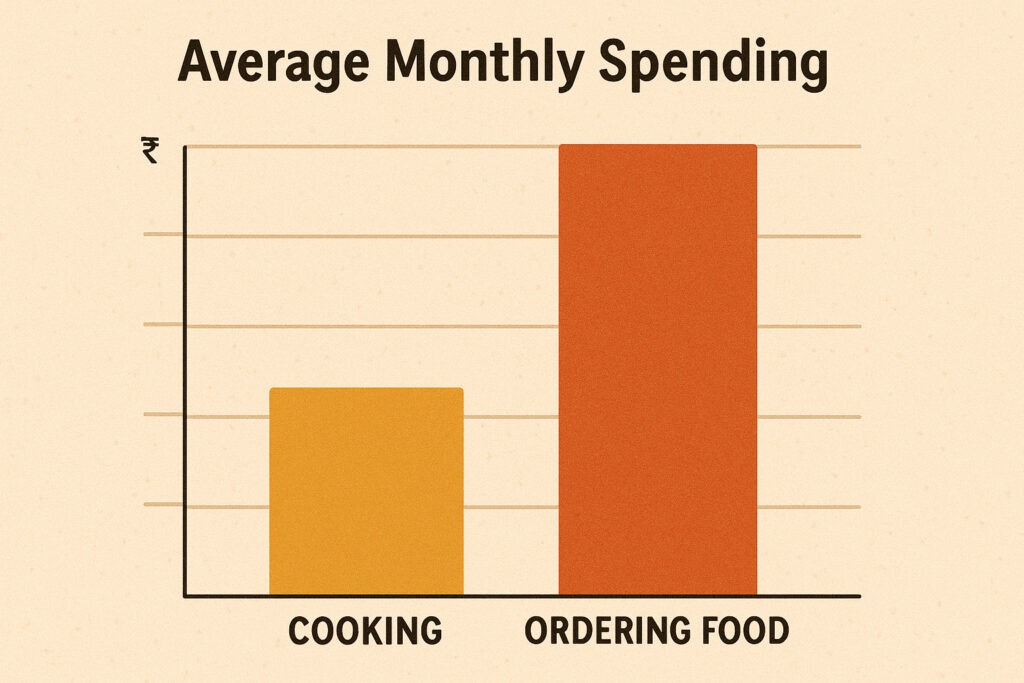

3. Cook More, Swiggy Less

Eating out = silent budget killer. Challenge: 3-day no-order streak.

If you’re aiming for how to save ₹1000 every month, reducing food delivery is a game-changer.

4. Use the 70-20-10 Rule

Breakdown:

- 70% needs (rent, bills, food)

- 20% savings (YES, your ₹1000 goal)

- 10% fun (guilt-free)

Following this rule gives you a structure for how to save ₹1000 every month without feeling deprived.

5. Make Your Savings Automatic

Set up an auto-transfer to a separate savings account right after salary hits.

Check Fi Money or Niyo — both offer smart savings features.

The easiest method for how to save ₹1000 every month is to never let yourself touch that ₹1000.

6. Cut the “Leak Expenses”

Examples:

- Subscriptions you forgot

- Daily chai + samosa = ₹600/month

- Impulse buys

These small leaks can sink a big ship. Plugging them is how to save ₹1000 every month with minimal pain.

7. Switch to Budget-Friendly Alternatives

Metro > Uber. Generic brands > Premium. Prepaid > Postpaid.

This mindset shift alone can help you understand how to save ₹1000 every month without major sacrifices.

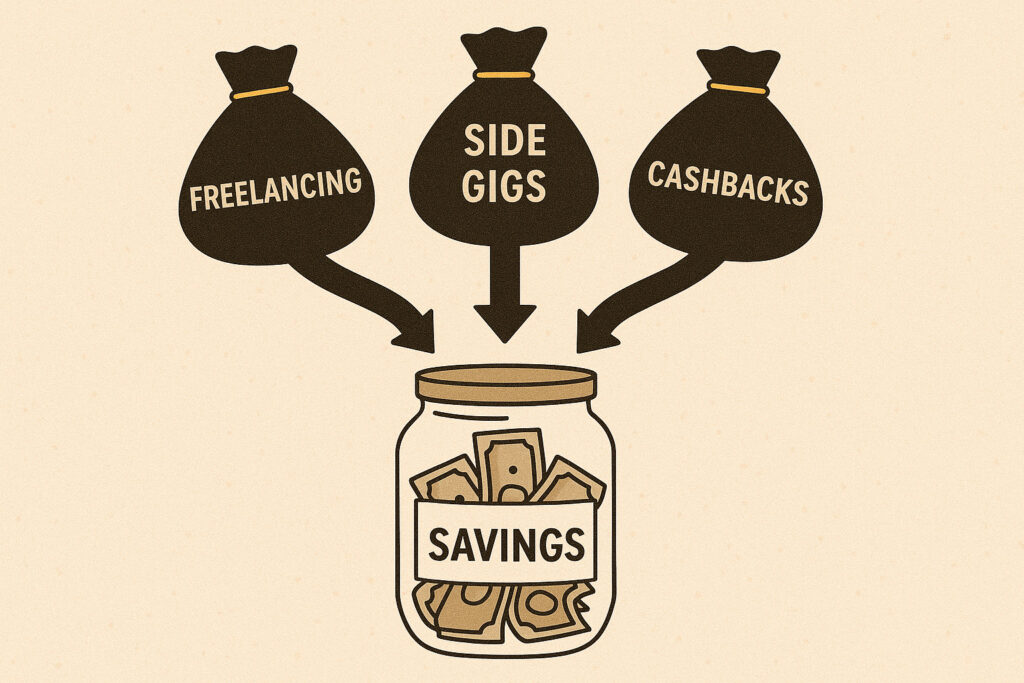

8. Use Cashback and Rewards Wisely

Pay via apps like Cred, [Paytm], or [Gpay] and redeem wisely.

But: Don’t spend more just for rewards.

Used correctly, they can shave off small amounts — another smart trick for how to save ₹1000 every month.

9. Start a Tiny Side Hustle

Earn ₹50-₹100/day = ₹1500–2000/month. Examples:

- Sell used items

- Offer resume help

- Freelance on Fiverr

Even a tiny gig can be how to save ₹1000 every month, especially if you’re tight on salary.

10. Try Reverse Budgeting

Instead of spending first and saving last, do the opposite. The moment you get paid, transfer ₹1000 to your savings, then manage expenses from the rest.

This simple flip is one of the most underrated hacks for how to save ₹1000 every month.

Mistakes People Make While Trying to Save ₹1000 Every Month

- Saving only when something is left (rarely happens)

- Setting unrealistic goals (like ₹5000 in a tight budget)

- Not separating savings from spending account

- Giving up after one failed month

Avoiding these mistakes will fast-track your success in learning how to save ₹1000 every month.

Psychological Hacks to Stick With Saving

- Rename your savings account to “Freedom Fund” or “New Phone Goal”

- Use visual savings trackers on your wall or phone

- Gamify the process — reward yourself with a free fun activity when you hit the monthly goal

These small tricks keep your motivation high as you learn how to save ₹1000 every month.

Real-Life Monthly Budget Example

Let’s say you earn ₹25,000/month:

| Category | Amount (INR) |

|---|---|

| Rent | 8,000 |

| Groceries | 4,000 |

| Transport | 1,500 |

| Utilities + Phone | 1,500 |

| Entertainment | 1,000 |

| Emergency Fund | 1,000 |

| Personal Care | 1,000 |

| Savings | 1,000 ⬆️ |

| Miscellaneous | 1,000 |

Alternative? Live with a roommate, reduce rent to ₹6000, and you might save ₹2000+ instead of ₹1000. That’s leveling up!

Free Tools to Help You Save

| Tool Name | Purpose |

| Google Sheets | Budget tracking |

| Notion | Habit + spending planner |

| Money View | Auto expense categorizing |

| Beehiiv | Get weekly money tips |

These free tools make your journey on how to save ₹1000 every month easier and more fun. Subscribe to my Beehiiv newsletter here and get these tools delivered in the welcome email (check your Promotions tab if you don’t see it right away).

FAQs on Saving ₹1000 a Month

Q1: Is ₹1000 enough to start investing?

Yes! Look into SIPs or digital gold. Even ₹500/month is enough to begin.

Q2: What if my expenses are too high?

Start by saving ₹200. Increase gradually. Even 1% saving habit is a win.

Q3: Should I pay off debt or save first?

If interest > 10%, prioritize debt. But build at least a ₹500/month emergency fund side-by-side.

Q4: How can I save more without killing my social life?

Budget for fun. Use free events. Alternate dine-outs with chai-dates. You deserve joy too!

Q5: What’s the best bank account to save ₹1000 a month?

Look for zero-balance savings accounts like Fi, Jupiter, or Paytm Payments Bank. No fees + easy auto-save = win.

Read this for more: Best Savings Accounts for Beginners in India

Q6: How long before I feel the benefit of saving ₹1000 a month?

Just 3 months = ₹3000 saved. Enough to handle minor emergencies, travel, or invest in a learning course.

Final Thoughts: Small Steps, Big Change

Learning how to save ₹1000 every month isn’t about sacrifice. It’s about choice. You’re building freedom, peace of mind, and confidence.

So next time you feel broke, remember:

You don’t need to be rich to start saving. You need to start saving to get rich.

Make your first ₹1000 this month. Then next. And the next.

This is how to save ₹1000 every month — one intentional decision at a time.

Let’s go! 🌟

Loved This Guide? Here’s What to Read Next:

- Emergency Fund: Why It’s Your First Financial Goal (Not Investing!)

- How to Start Budgeting for Beginners

- SIP, FD, or RD? What I Found Out as a Totally Confused Beginner