💰 SIP vs FD vs RD: The Honest Beginner’s Guide to Choosing the Right One for Your Money

Not long ago, I was staring at my banking app like it was a Rubik’s cube.

There were options like SIP vs FD vs RD — and I had no clue where to put my hard-earned ₹500.

So I did what every confused beginner does — Googled like crazy, watched three YouTube videos, got even more confused, and finally figured it out for real.

In this post, I’ll break down SIP vs FD vs RD in the most beginner-friendly, no-jargon way possible — so you never have to feel clueless like I did.

📖 Table of Contents

- What Is SIP?

- What Is FD?

- What Is RD?

- SIP vs FD vs RD: Quick Comparison

- Which One Did I Choose?

- FAQs About SIP, FD & RD

- Final Thoughts

💸 What Is SIP (Systematic Investment Plan)?

SIP, or Systematic Investment Plan, is like putting your money on autopilot — but instead of a bank account, it goes into a mutual fund.

Want to learn about best savings account in India? Here is the detailed information on the Top 5 Best Savings Accounts for Beginners in India

You’re investing monthly, and your money is growing with the market.

✅ Key Features of SIP:

- Invest as low as ₹100–₹500/month

- Money goes into equity or debt mutual funds

- Return depends on market performance

- No lock-in; you can withdraw anytime (unless ELSS)

👍 Pros of SIP:

- Great for long-term wealth creation

- Helps build investment discipline

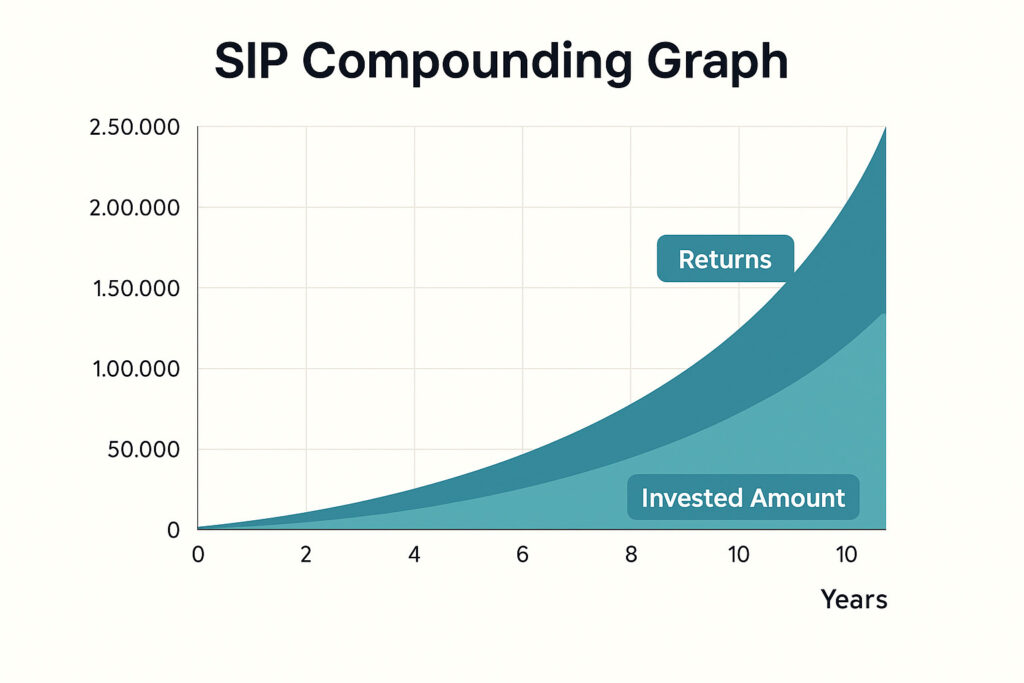

- You benefit from compounding

- Historically gives better returns than FD or RD

👎 Cons:

- Not for short-term goals

- Returns are not guaranteed

- Can be risky in volatile markets

💡 Example:

SIP ₹500/month for 10 years at 12% = ₹1.14 lakh (from ₹60,000 invested)

Want to see how your SIP might grow? Try this SIP calculator and play with the numbers yourself.

🏦 What Is FD (Fixed Deposit)?

FD is the classic Indian favorite.

You put in a lump sum (say ₹10,000) in your bank, and they lock it for a fixed period — 6 months, 1 year, or even 5 years.

They give you a fixed interest rate (usually around 6.5%, but you can check the latest FD interest rates here).

✅ Key Features of FD:

- One-time deposit

- Locked for 7 days to 10 years

- Return rate ~6–7%

- 100% secure (especially in govt. banks)

👍 Pros:

- Fully safe and stable

- Works great for emergency funds

- Predictable growth

👎 Cons:

- Low returns

- Penalty on early withdrawal

- Tax on interest earned

💡 Example:

₹10,000 in FD at 6.5% for 5 years = ₹13,800 on maturity

🪙 What Is RD (Recurring Deposit)?

RD is like the safe middle ground between SIP and FD. You invest a fixed amount every month with your bank — and they give you a fixed interest rate at the end.

RD is like SIP’s traditional cousin — done through a bank instead of mutual funds, and fully regulated under RBI’s RD guidelines.

It’s perfect for someone who wants discipline without risk.

✅ Key Features of RD:

- Invest monthly (₹500, ₹1,000, etc.)

- Fixed interest rate (6–6.5%)

- Lock-in period (1 to 5 years)

👍 Pros:

- Very safe

- Forces consistent saving habit (Learn how to save money in you 20s)

- Good for short-term goals (like buying a phone)

👎 Cons:

- Fixed returns — no market growth

- Early closure penalty

- Can’t beat inflation

💡 Example:

₹500/month RD for 5 years at 6.25% = ~₹35,000 (₹30,000 invested)

⚖️ SIP vs FD vs RD: Quick Comparison Table

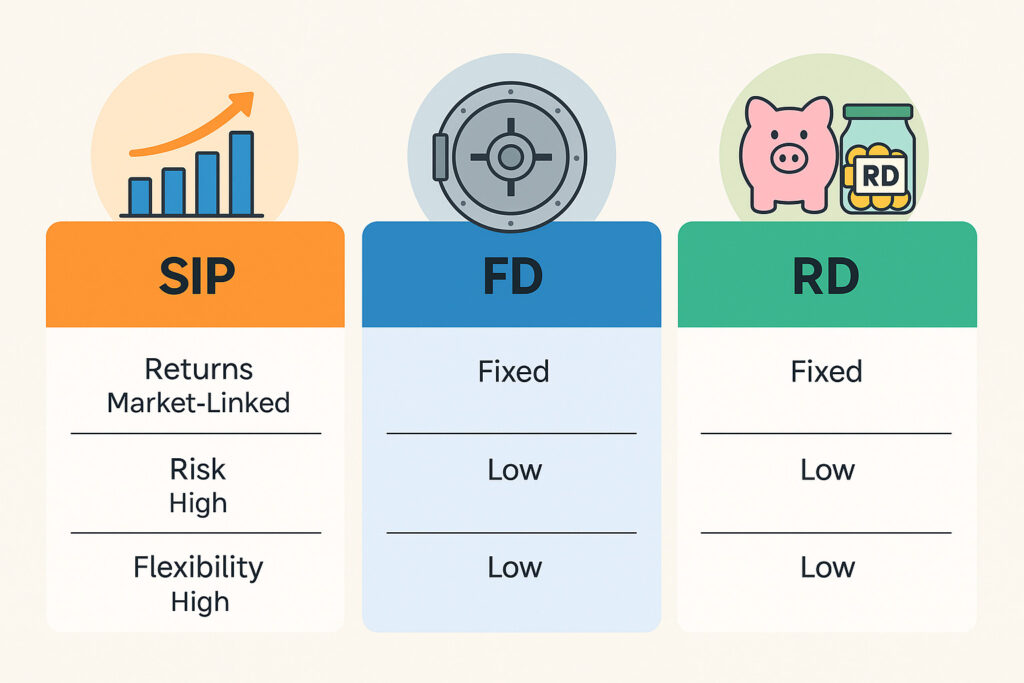

| Feature | SIP | FD | RD |

|---|---|---|---|

| Investment Type | Monthly in Mutual Funds | One-time Lump Sum | Monthly in Bank |

| Risk | Medium to High (Market-based) | Very Low | Very Low |

| Return Range | 10–15% (Variable) | 6–7% (Fixed) | 6–6.5% (Fixed) |

| Lock-in Period | None (unless ELSS) | Yes (Premature penalty) | Yes (Premature penalty) |

| Ideal For | Long-term Wealth | Emergency/Safe Savings | Short-term Goals |

| Tax on Returns | Capital Gains | Taxable | Taxable |

Keep in mind: Interest earned on FD and RD is fully taxable. Here’s a simple guide on how FD and RD interest is taxed in India.

🤔 SIP vs FD vs RD – Which One Did I Choose?

At first, I started with RD — it felt safe, simple, and easy.

But I quickly realized I wasn’t growing my money, just saving it.

Now I invest ₹500/month in a balanced SIP (mutual fund) and keep a small FD for emergency savings.

If you’re just starting — you don’t need to pick one. You can combine all three based on your goals.

❓ FAQs About SIP vs FD vs RD

Q1. Which is safest — SIP vs FD vs RD?

➡️ FD and RD are safest. SIP has higher return potential but comes with risk.

Q2. What gives the highest return?

➡️ SIP — especially in equity mutual funds over long term (5–10 years).

Q3. Can I do all three?

➡️ Absolutely! SIP for growth, FD for safety, RD for habits.

Q4. What’s the minimum I need to start?

➡️ SIP: ₹100–500/month

➡️ RD: ₹100–500/month

➡️ FD: ₹1,000+

Q5. Are SIP returns guaranteed?

➡️ No. But if you stay long-term, chances of profit are high.

🏁 Final Thoughts

If you’re feeling overwhelmed by SIP vs FD vs RD, you’re not alone — I was the same.

But here’s the truth:

There’s no “best” option — only the right one for your need.

- Want long-term growth? 👉 Go with SIP.

- Want guaranteed safety? 👉 FD.

- Want to save monthly with zero market stress? 👉 RD.

Just don’t overthink it. Even ₹500 is enough to start.

Start small. Stay consistent. And watch yourself grow — not just financially, but mentally too.

🚀 Want to Start Saving Smarter?

🎁 Grab my free ₹500 Budget Toolkit here 👉 [Subscribe me]

It’s the same one I use to manage my budget like a boss!